THE LATEST FROM THE

Keep It Simple Blog

Sign Up to Receive the Newsletter

A Monthly Look at Steady Portfolio Income

A monthly overview of how a diversified portfolio generates steady income. This update explains where income comes from and how different strategies work together to support long-term planning.

Yield and Stability in Private Investments

Public markets in September were marked by choppiness — interest rate anxiety, weak consumer sentiment, and renewed recession chatter pulled headlines in every direction. But in the private markets? A different story. Private credit held steady. Real estate kept...

How To Measure Investment Risk: It Isn’t One-Size-Fits-All

Investors and Advisors may see risk differently. This post explores how these perspectives differ, and how aligning them can lead to better investment decisions and a more comfortable portfolio experience.

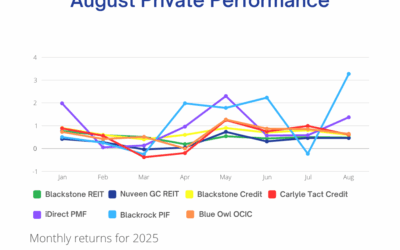

Trusted Private Market Strategy: Unlocking Stable Income and Growth

August was another month of quiet strength across private markets. BPIF surged, credit kept paying, and real estate remained reliable — underscoring the role of these funds in a long-term plan.

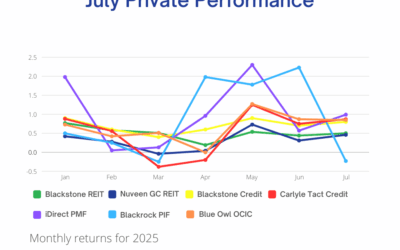

Private Performance in July: See Stable Income and Growth

July saw private markets continue doing what they do best: providing consistent income and long-term focus in a choppy, distracted world. From disciplined credit managers to globally diversified REITs, this month was about quiet execution — not flashy headlines.

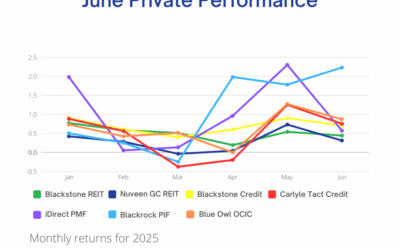

June 2025 Private Investments: Strong Yields, Low Volatility, Real Progress

June’s update shows continued strength in private equity and credit, with income-focused funds compounding quietly while public markets struggled for direction. Private strategies remain the portfolio anchor in a volatile year.

The One Big Beautiful Bill Act: What the New Tax Law Means for Your Financial Plan

The One Big Beautiful Bill Act (OBBBA) was signed into law on July 4, 2025, with much fanfare and yes, the name sounds like something dreamed up in a focus group. But beyond the marketing, this bill brings real, sweeping changes to the tax code. These updates affect...

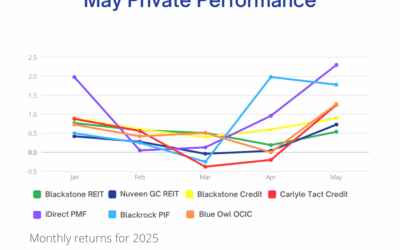

Private Investments Update: May 2025 Performance

Another strong month for May 2025 Private Performance. While public markets wrestled with conflicting economic signals and an unsettled rate outlook, private equity, credit, and real estate strategies quietly did their job: providing steady income, stable growth, and...

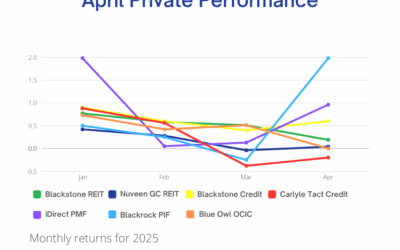

April 2025 Private Performance

April reminded us yet again why private investments continue to serve as the ballast of long-term portfolios. While public markets were roiled by tariff announcements and conflicting Fed commentary, private investment strategies largely held steady. Performance across...

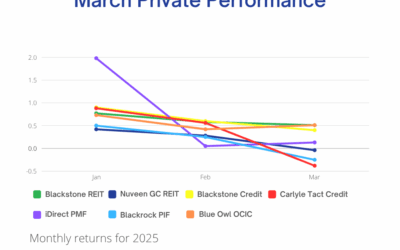

March 2025 Private Performance

As we closed out the first quarter of 2025, public markets continued to show their familiar pattern of volatility, with swings driven by mixed economic data, shifting Fed expectations, and ongoing global tensions. Amidst that backdrop, private investments once again...

Riding Out the Storm: Lessons from Amazon’s Stock Volatility

This recent spat of of volatility has put a lot of people on their heels. But if you've ever wondered what true stock market volatility looks like, take a closer look at Amazon. Since 1999, this iconic tech giant has experienced no fewer than six major declines1, each...

SECURE Act Final Regulations: What They Mean for IRA Beneficiaries

When the SECURE Act was passed in 2019, it reshaped retirement planning—particularly for inherited IRAs. Then, in 2022, the IRS issued proposed regulations that further complicated interpretations of the law. Now, with the July 2024 Final Regulations, we have...