As we closed out the first quarter of 2025, public markets continued to show their familiar pattern of volatility, with swings driven by mixed economic data, shifting Fed expectations, and ongoing global tensions. Amidst that backdrop, private investments once again delivered the kind of stability and income-focused returns that have made them an increasingly valuable complement to public markets. While private investments aren’t immune to market forces, they continue to demonstrate why diversifying beyond traditional stocks and bonds can provide meaningful benefits for long-term investors.

Private Equity: Navigating Selective Growth

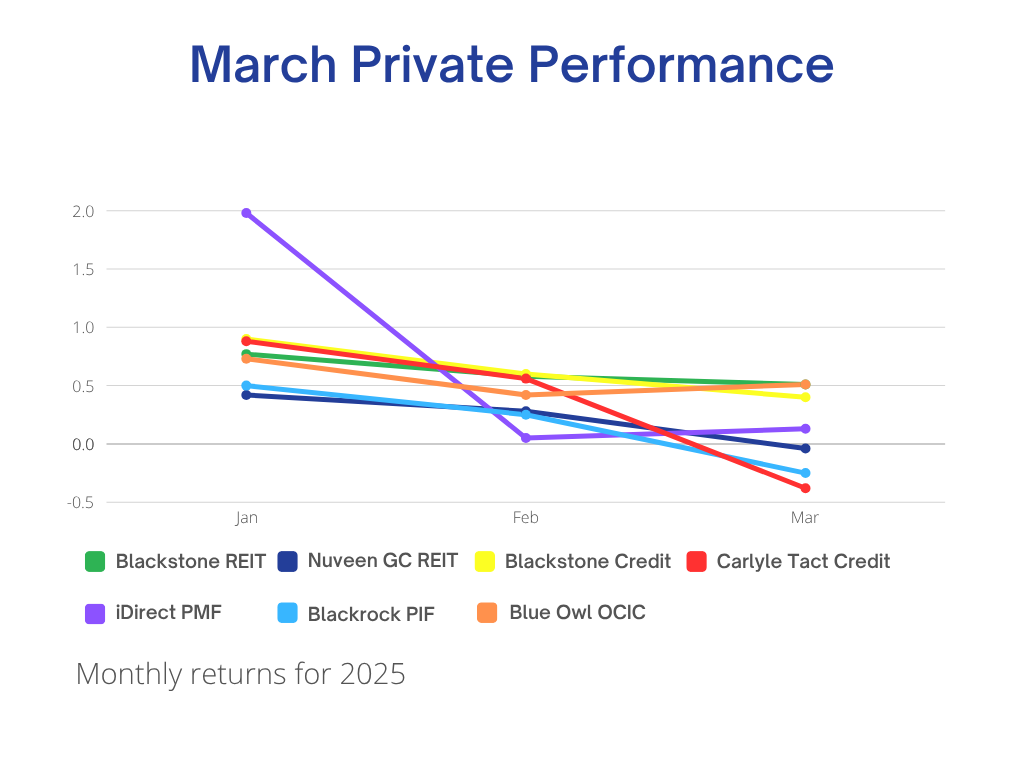

BlackRock Private Investments Fund (BPIF) posted a modest decline of -0.25% for March, bringing its year-to-date performance to 0.50%. Even with recent softness, the fund remains well-diversified across direct and secondary private equity opportunities. BlackRock’s deal flow remains active, with over 1,200 deals sourced during 2024. The fund’s sector exposures continue to emphasize software, healthcare, and financial services, with the majority of its capital allocated toward buyouts and growth equity

iDirect Private Markets Fund returned 0.13% in March, boosting its year-to-date gain to 2.16%. The fund maintains its multi-manager approach with allocations to KKR, Vista Equity Partners, and Warburg Pincus, providing broad diversification across private equity sub-sectors. Recent deal activity highlights continued exposure to growth buyouts in information technology, healthcare, and industrials

Private Real Estate: Steady Cash Flow with Targeted Growth

Blackstone Real Estate Income Trust (BREIT) delivered a 0.51% return in March, bringing its year-to-date performance to 1.87%. The portfolio remains concentrated in rental housing, industrial, and data center sectors, with 66% of its real estate holdings located in fast-growing Sunbelt markets. BREIT continues to benefit from high occupancy (94%) and stable cash flow, reflected in its 4.80% annualized distribution rate.

Nuveen Global Cities REIT (GCREIT) was flat to slightly negative for the month at -0.04%, holding year-to-date returns at 0.66%. GCREIT remains diversified globally and across multiple real estate sectors, including industrial, healthcare, necessity retail, and multifamily housing. While property values have seen some modest recalibration, stabilized income continues to anchor overall returns, with an attractive 5.51% dividend yield.

Private Credit: Income Remains Consistent Amid Market Noise

Blackstone Private Credit Fund (BCRED) posted a 0.40% return for March, with year-to-date gains at 1.90% and an annualized distribution rate of 10.5%. The fund continues to emphasize first-lien senior secured lending, with 97% of its portfolio in senior secured floating-rate loans.

Carlyle Tactical Private Credit (C•TAC) saw a pullback in March, returning -0.38%, leaving its year-to-date return at 1.06%. The fund continues to actively manage across direct lending, opportunistic credit, and structured finance while tactically adjusting to market shifts.

Blue Owl Credit Income Corp (OCIC) returned 0.51% for the month, bringing its year-to-date return to 1.71%, while maintaining an annualized distribution yield of 10.16%. The portfolio remains heavily allocated to senior secured lending within healthcare, insurance, and professional services.

| Performance | May | Year to Date | Annualized Dividend Rate |

| Blackstone REIT1 | .51% | 1.87% | 4.80% |

| Nuveen Global Cities REIT2 | -.04% | .66% | 5.51% |

| Blackstone Private Credit3 | .40% | 1.90% | 10.5% |

| Carlyle Tactical Credit4 | -.38% | 1.06% | 9.88% |

| Blue Owl OCIC5 | .51% | 1.71% | 10.16% |

| iDirect Private Markets Fund6 | .13% | 2.16% | – |

| BlackRock Private Investment Fund7 | -.25% | .50% | – |

Conclusion: Why Private Markets Remain a Core Allocation

The first quarter of 2025 has once again highlighted why private investments play a critical role in client portfolios. While public markets continue to swing in response to headlines, private investments are driven by long-term business fundamentals and contractual cash flows. Whether it’s private equity navigating selective growth, real estate generating tax-advantaged income, or private credit providing reliable yield, the asset class continues to deliver stability, diversification, and opportunity in today’s complex markets.

Have questions about how private investments can support your portfolio strategy? Let’s connect and discuss the opportunities available to you.

- https://www.breit.com/performance/

- https://www.nuveen.com/gcreit/performance

- https://www.bcred.com/performance/

- https://www.carlyle.com/ctac

- https://ocic.com

- https://idirectpmfund.com/idirect-pm-fund/performance/#performance

- https://bpif.com/portfolio-and-performance/default.aspx

This content is developed from sources believed to be providing accurate information. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security.