April reminded us yet again why private investments continue to serve as the ballast of long-term portfolios. While public markets were roiled by tariff announcements and conflicting Fed commentary, private investment strategies largely held steady. Performance across real estate, credit, and equity remained consistent — with lower volatility and meaningful income — offering investors the kind of predictability that is increasingly hard to find in traditional asset classes.

Private Equity: Breakout Month for BPIF

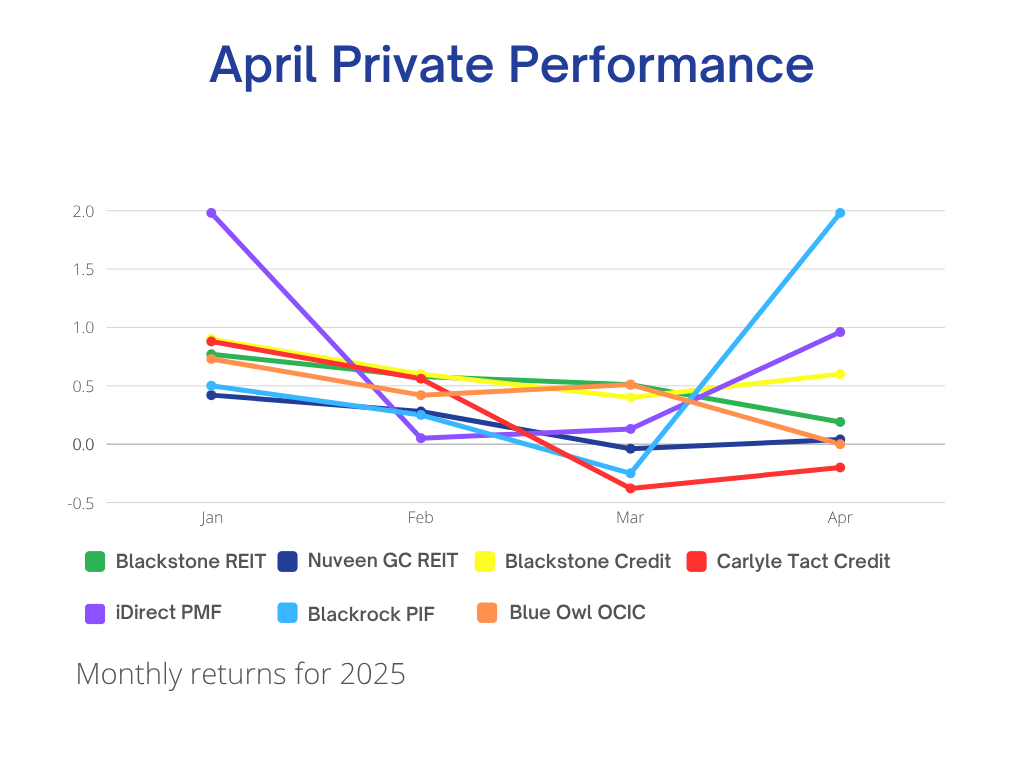

BlackRock Private Investment Fund (BPIF) led the way in April, delivering a standout 1.98% return, its strongest monthly performance since inception, bringing the fund to +2.49% YTD. This bump was driven by valuation growth in direct private equity holdings and secondary positions. With a portfolio concentrated in growth buyouts and software, healthcare, and financial services companies, BPIF’s performance reflects long-term strategy execution amidst short-term market noise.

iDirect Private Markets Fund also posted a strong month at 0.96%, bringing its YTD return to 3.14%. Backed by top-tier private equity sponsors (KKR, Warburg Pincus, Vista), the fund continues to provide investors with diversified access to institutional-grade deals. Recent capital calls centered around enterprise software and business services reflect themes we expect to continue throughout 2025.

Private Real Estate: Income Remains Steady Amid Global Rate Tensions

Blackstone REIT (BREIT) returned 0.19% in April, bringing its year-to-date total to 2.07%. BREIT’s strategy remains focused on sectors with strong secular tailwinds — namely rental housing, industrial logistics, and data centers, which now make up 87% of the portfolio. Occupancy remains stable at 93%, and distribution yield holds firm at 4.8% .

Nuveen Global Cities REIT (GCREIT) returned a modest 0.04%, holding YTD performance at 0.69%. The fund’s globally diversified mix of industrial, healthcare, and necessity retail continues to provide income consistency with a 5.51% annualized distribution, supported by 94% occupancy and relatively conservative leverage levels .

Private Credit: Consistent Income With Tactical Shifts

Blackstone Private Credit (BCRED) delivered another solid month, returning 0.60%, now +2.60% YTD, with a 10.5% annualized distribution yield. The fund remains largely invested in first-lien, floating-rate senior secured loans, positioning it to continue delivering strong income even if rates stay higher for longer .

Blue Owl Credit Income Corp (OCIC) was flat in April (0.00% return), but remains +1.72% YTD, supported by its consistent 10.16% dividend yield. The fund’s portfolio remains heavily weighted to senior secured loans in healthcare, insurance, and professional services, showing strong credit quality and low realized losses .

Carlyle Tactical Credit (C•TAC) posted a slight decline of -0.20%, trimming its YTD return to 0.86%. The fund continues to pivot across direct lending, opportunistic credit, and structured products — and added $100M in new capital via preferred share issuance in April, supporting future deployment flexibility.

| Performance | April | Year to Date | Annualized Dividend Rate |

| Blackstone REIT1 | .19% | 2.07% | 4.80% |

| Nuveen Global Cities REIT2 | .04% | .69% | 5.51% |

| Blackstone Private Credit3 | .60% | 2.60% | 10.5% |

| Carlyle Tactical Credit4 | -.20% | .86% | 9.88% |

| Blue Owl OCIC5 | .00% | 1.72% | 10.16% |

| iDirect Private Markets Fund7 | .96% | 3.14% | – |

| BlackRock Private Investment Fund8 | 1.98% | 2.49% | – |

Conclusion: Steady Flow, Solid Foundation

While April was a reminder of how quickly sentiment can shift in public markets, private investments stayed true to their value: lower short-term volatility, reliable income, and strategic exposure to long-term themes. For clients looking to smooth portfolio returns while still participating in innovation and growth, these strategies continue to deliver.

Have questions about how private investments can support your portfolio strategy? Let’s connect and discuss the opportunities available to you.

- https://www.breit.com/performance/

- https://www.nuveen.com/gcreit/performance

- https://www.bcred.com/performance/

- https://www.carlyle.com/ctac

- https://ocic.com

- https://www.priorityincomefund.com/

- https://idirectpmfund.com/idirect-pm-fund/performance/#performance

- https://bpif.com/portfolio-and-performance/default.aspx

This content is developed from sources believed to be providing accurate information. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security.