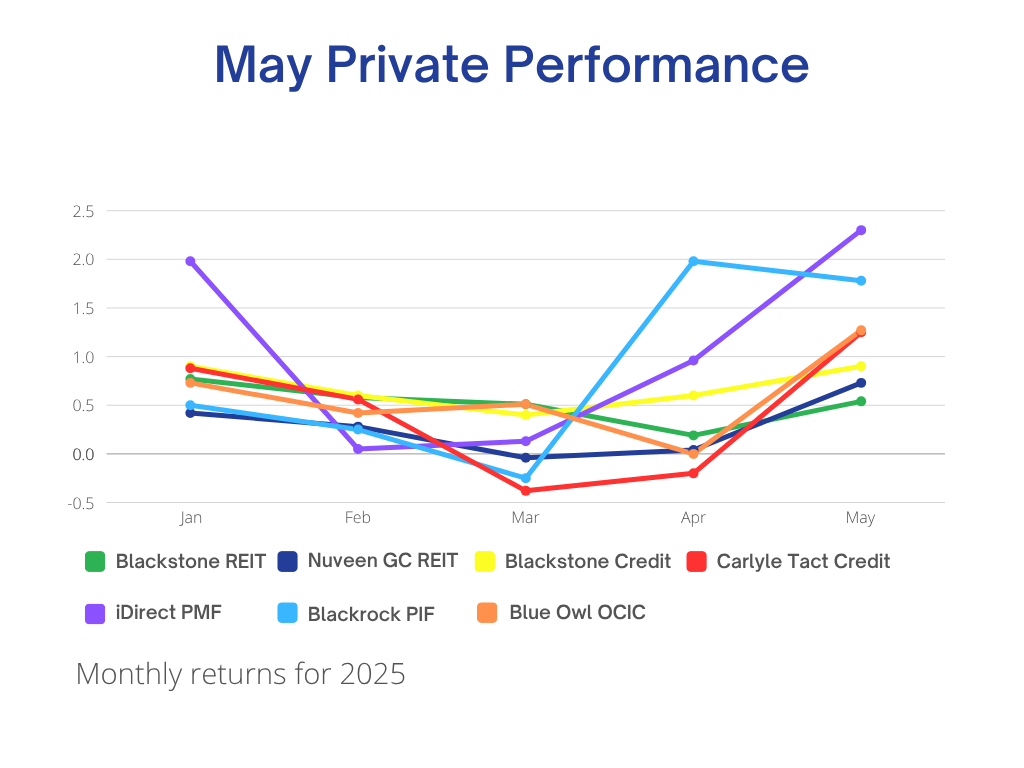

Another strong month for May 2025 Private Performance. While public markets wrestled with conflicting economic signals and an unsettled rate outlook, private equity, credit, and real estate strategies quietly did their job: providing steady income, stable growth, and lower volatility. For clients looking to balance risk and reward in an unpredictable market, private allocations once again showed their value. Let’s dive into May’s results.

Private Equity: Momentum Building for Direct & Secondary May 2025 Private Performance

BlackRock Private Investment Fund (BPIF) delivered another robust month, posting +1.78% for May, bringing its year-to-date May 2025 private performance to 4.31%. The portfolio remains balanced between direct buyouts and high-quality secondaries with software, healthcare, and financial services companies continuing to lead the growth story.

iDirect Private Markets Fund surged ahead with a +2.30% return in May, pushing its YTD to an impressive 5.52%. The fund’s multi-manager structure, anchored by top sponsors like KKR and Warburg Pincus, continues to give clients diversified access to institutional deals, particularly across growth equity and infrastructure.

Private Real Estate: Fundamentals Still Favor Resilient Sectors in May 2025 Private Performance

Blackstone REIT (BREIT) returned 0.54% in May, lifting its YTD performance to 2.62%, with an annualized distribution rate of 4.80%. High conviction positions in rental housing, industrial, and data centers remain the core pillars, with strong demand and constrained new supply helping stabilize cash flows.

Nuveen Global Cities REIT (GCREIT) posted a standout 0.73% for the month, now +1.43% YTD, and its annualized distribution rate edged up to 5.57%. Global diversification and a strategic overweight to industrial and healthcare assets continue to drive income consistency with relatively low leverage.

Private Credit: Steady Income That Keeps Compounding in May 2025 Private Performance

Private credit remained a bright spot, once again delivering some of the strongest risk-adjusted returns:

- Blackstone Private Credit (BCRED) came in at +0.90% for May (3.60% YTD) with an attractive 10.5% annualized yield. The portfolio is over 97% senior secured floating-rate loans — a resilient structure in the current rate environment.

- Carlyle Tactical Credit (C•TAC) rebounded nicely with a 1.25% monthly gain, bringing YTD to 2.11% and maintaining a 9.88% yield. The fund’s tactical allocation across direct lending, opportunistic credit, and real assets remains a differentiator.

- Blue Owl Credit Income Corp (OCIC) delivered +1.27% for May, now 3.01% YTD, with a solid 10.19% annualized yield. OCIC’s focus on middle-market senior secured lending continues to provide stable cash flow in a choppy public market backdrop.

| Performance | May | Year to Date | Annualized Dividend Rate |

| Blackstone REIT1 | .54% | 2.62% | 4.80% |

| Nuveen Global Cities REIT2 | .73% | 1.43% | 5.57% |

| Blackstone Private Credit3 | .90% | 3.60% | 10.5% |

| Carlyle Tactical Credit4 | 1.25% | 2.11% | 9.88% |

| Blue Owl OCIC5 | 1.27% | 3.01% | 10.19% |

| iDirect Private Markets Fund6 | 2.30% | 5.52% | – |

| BlackRock Private Investment Fund7 | 1.78% | 4.31% | – |

Conclusion: Private Allocations Continue to Earn Their Place

Volatility across stocks and bonds may be here to stay but for patient investors, private markets continue to generate attractive yields and balanced growth, without the daily noise. As we move into the summer, these strategies will remain an essential anchor for portfolios that value predictable income and reduced volatility.

Have questions about how private investments can support your portfolio strategy? Visit our page: 9M Investments and get a free assessment so we can start discussing the opportunities available to you.

- https://www.breit.com/performance/

- https://www.nuveen.com/gcreit/performance

- https://www.bcred.com/performance/

- https://www.carlyle.com/ctac

- https://ocic.com

- https://idirectpmfund.com/idirect-pm-fund/performance/#performance

- https://bpif.com/portfolio-and-performance/default.aspx

This content is developed from sources believed to be providing accurate information. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security.