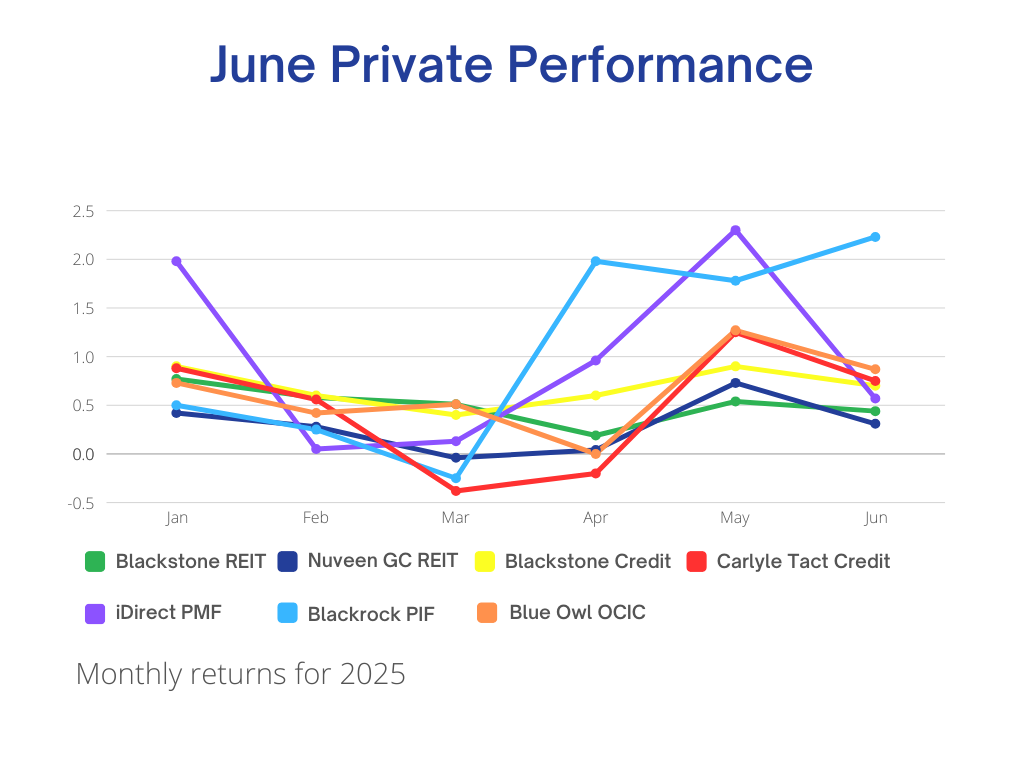

While public markets grappled with inflation prints, shifting rate expectations, and narrow leadership in stocks, June 2025 Private Investments quietly continued doing what they’re built to do: generate consistent income, capture long-term growth, and smooth out portfolio volatility.

August saw steady gains across private credit and real estate, while private equity came in strong with one fund delivering its best monthly performance in over a year. Together, these funds continue to demonstrate why disciplined private market exposure remains a core component of resilient wealth planning.

Private Real Estate: The Foundation of June 2025 Private Investments

BlackRock Private Investment Fund (BPIF) posted a +2.23% return in June, now up +6.63% YTD — making it one of the top-performing holdings year to date. The portfolio continues to benefit from exposure to fast-growing sectors like software and healthcare, with secondary investments adding diversification and early liquidity.

iDirect Private Markets Fund also delivered a solid +0.57% for the month, closing the first half of 2025 at +6.12% YTD. Allocations to KKR, Vista Equity, and Warburg Pincus continue to provide diversified access to institutional-quality private equity deals across high-growth industries.

Private Real Estate: The Foundation of June 2025 Private Investments

Blackstone Real Estate Income Trust (BREIT) returned +0.44% in June, bringing its YTD return to +3.07% with a 4.80% distribution yield. The fund remains overweight rental housing and industrial warehouses in high-growth U.S. markets, with over 93% occupancy. Demand for data centers remains a key tailwind.

Nuveen Global Cities REIT (GCREIT) returned +0.31%, now +1.74% YTD, with a strong 5.55% distribution rate. Its international exposure and focus on necessity retail, healthcare, and logistics centers continue to support stable cash flow, even as global rates remain elevated.

Private Credit: Quietly Compounding at 10%+

Income continues to flow through private credit, with all three core funds posting positive monthly returns:

- Blackstone Private Credit (BCRED):

+0.70% in June, +4.30% YTD, with a 10.5% yield. Portfolio remains primarily in senior secured, floating-rate corporate loans — well-positioned if rates stay “higher for longer.”

- Carlyle Tactical Credit (C•TAC):

+0.75% in June, +2.86% YTD, yield of 9.63%. Carlyle’s June update highlighted opportunistic allocations into asset-backed finance and infrastructure credit, along with continued capital inflows via preferred shares.

- Blue Owl Credit Income Corp (OCIC):

+0.87% in June, now +3.91% YTD, with a 10.24% yield. Senior secured middle-market loans continue to provide durable income and low volatility across a broad range of industries.

June 2025 Private Investments Performance Snapshot

| Fund | June | YTD | Annualized Dividend Rate |

|---|---|---|---|

| Blackstone REIT (BREIT)1 | 0.44% | 3.07% | 4.80% |

| Nuveen Global Cities REIT2 | 0.31% | 1.74% | 5.55% |

| Blackstone Private Credit3 | 0.70% | 4.30% | 10.5% |

| Carlyle Tactical Credit (C•TAC)4 | 0.75% | 2.86% | 9.63% |

| Blue Owl OCIC5 | 0.87% | 3.91% | 10.24% |

| iDirect Private Markets Fund6 | 0.57% | 6.12% | N/A |

| BlackRock Private Investment7 Fund (BPIF) | 2.23% | 6.63% | N/A |

Conclusion: No Drama, Just Progress for June 2025 Private Investments

When volatility dominates headlines, June 2025 Private Investments offer something different: structure, strategy, and steady execution. Whether it’s the dependable income from private credit, the global diversification of real estate, or the long-term upside of private equity August reinforced the case for keeping private markets at the core of a well-diversified portfolio. For more insights on how these strategies can optimize your wealth plan, visit 9M Investments to get a free assessment.

This content is developed from sources believed to be providing accurate information. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security.