by Jacob Millican | Mar 7, 2026 | Performance

February continued the strong start to the year for the Income Bucket strategy. After January returned to a more normalized income profile following year-end timing effects, February’s results reflected both the steady income generation of the core holdings and...

by Jacob Millican | Feb 12, 2026 | Performance

This monthly update focuses on one of the most important parts of every financial plan: steady portfolio income. Each month, I break down how the Income Bucket is positioned, what’s driving current results, and how the different parts of the portfolio work together to...

by Jacob Millican | Jan 15, 2026 | Performance

This monthly update focuses on one of the most important parts of every financial plan: steady, repeatable income. Each month, I break down how the Income Bucket is positioned, what’s driving current results, and how the different pieces of the portfolio work together...

by Jacob Millican | Dec 11, 2025 | Performance

This month starts a new ongoing update focused on one of the most important parts of every financial plan: the Income Bucket. Each month, I break down how this sleeve of the portfolio is built, what it’s meant to do, and how the different pieces—private real estate,...

by Jacob Millican | Nov 20, 2025 | Performance

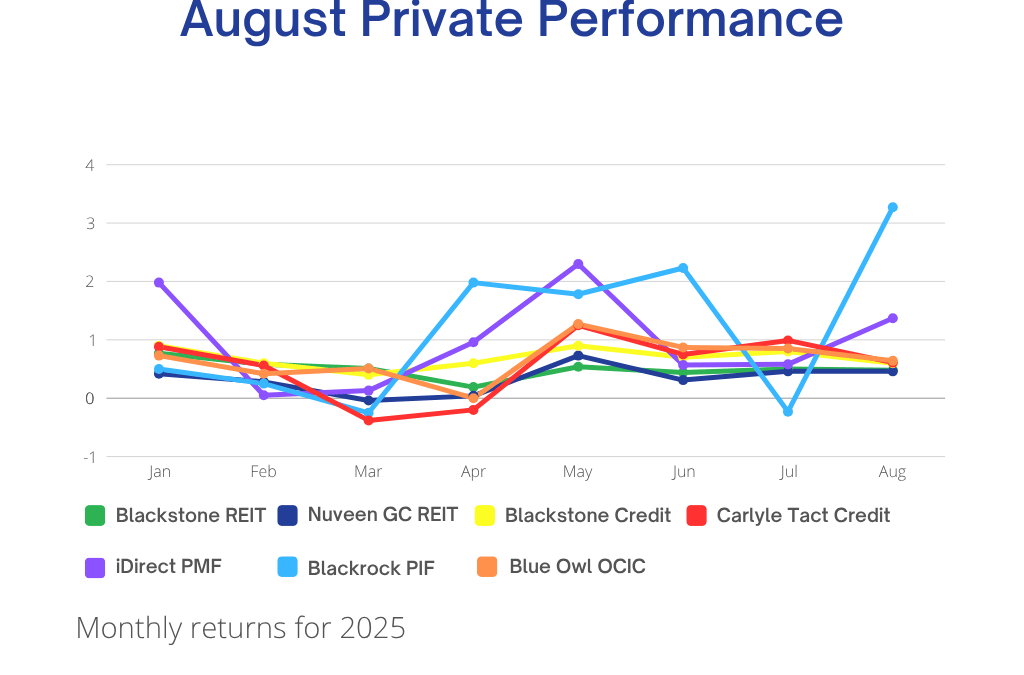

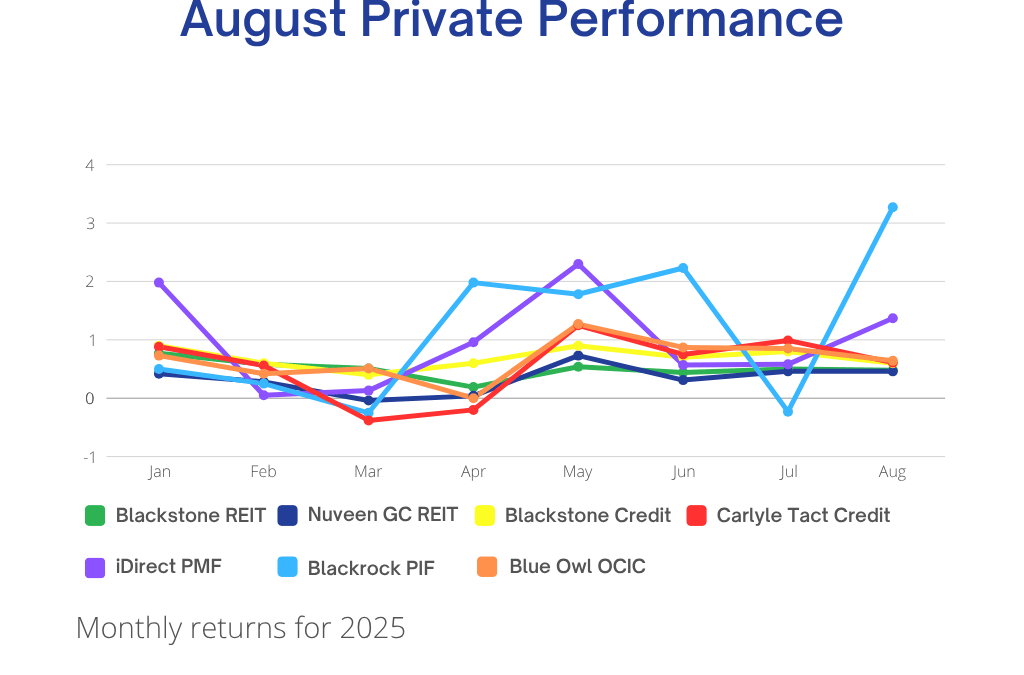

Public markets in September were marked by choppiness — interest rate anxiety, weak consumer sentiment, and renewed recession chatter pulled headlines in every direction. But in the private markets? A different story. Private credit held steady. Real estate kept...

by Jacob Millican | Oct 16, 2025 | Performance

While public markets grappled with inflation prints, shifting rate expectations, and narrow leadership in stocks, private investments quietly continued doing what they’re built to do: generate consistent income, capture long-term growth, and smooth out portfolio...