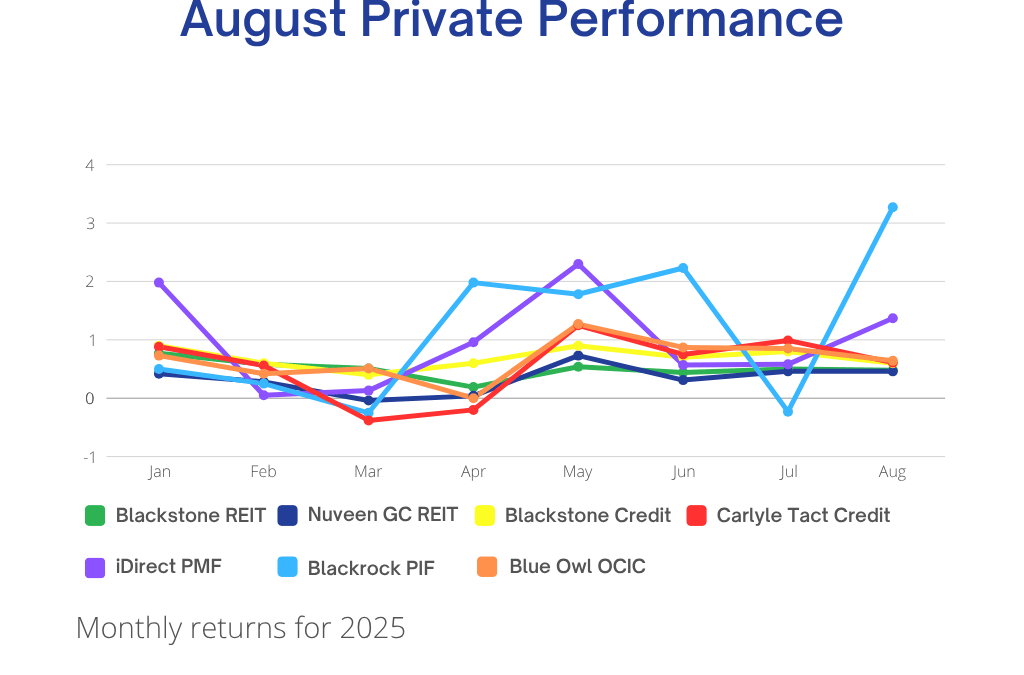

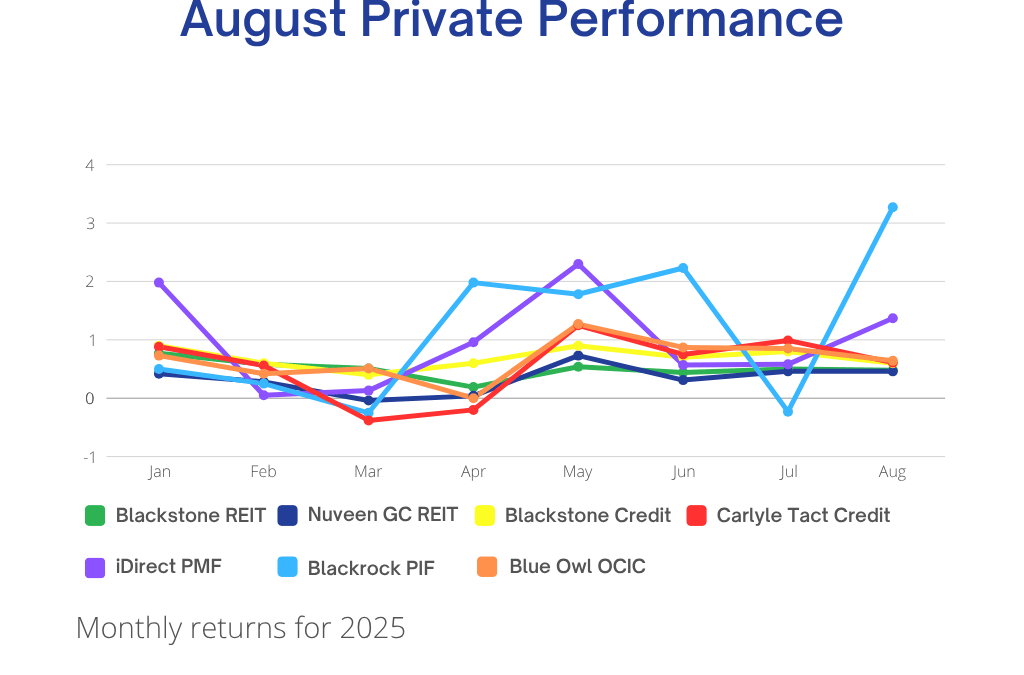

by Jacob Millican | Nov 20, 2025 | Performance

Public markets in September were marked by choppiness — interest rate anxiety, weak consumer sentiment, and renewed recession chatter pulled headlines in every direction. But in the private markets? A different story. Private credit held steady. Real estate kept...

by Jacob Millican | Oct 30, 2025 | Financial Planning, Investment

Understanding the Disconnect Between Relative and Absolute Risk For investors, wealth isn’t just about numbers it’s about security, opportunity, and legacy. Yet, when it comes to managing investments, there’s often a disconnect between how financial advisors assess...

by Jacob Millican | Oct 16, 2025 | Performance

While public markets grappled with inflation prints, shifting rate expectations, and narrow leadership in stocks, private investments quietly continued doing what they’re built to do: generate consistent income, capture long-term growth, and smooth out portfolio...

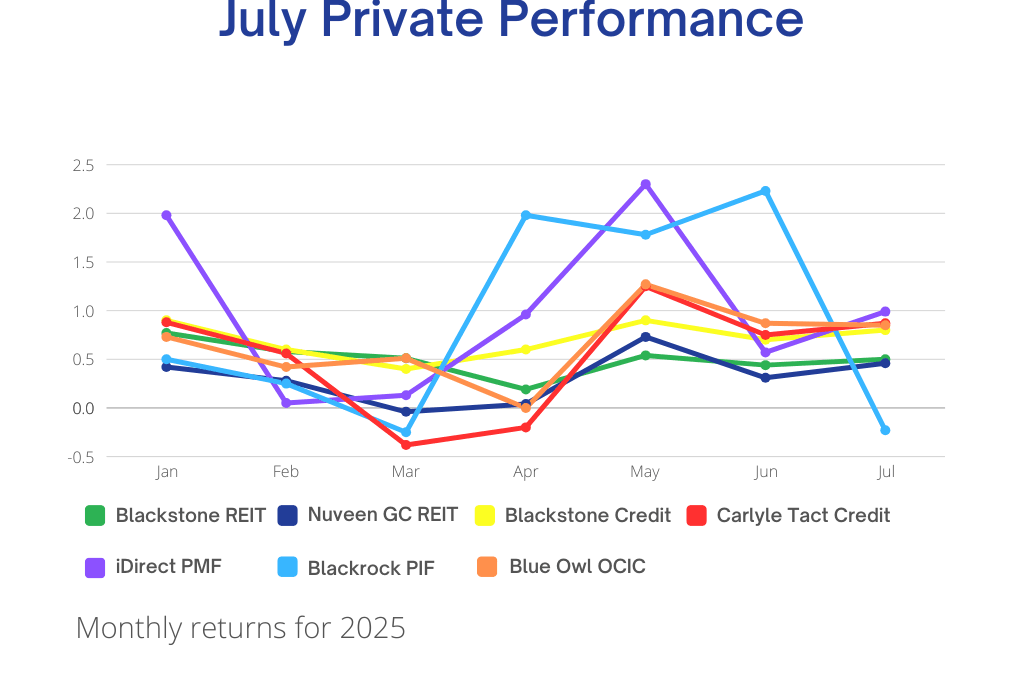

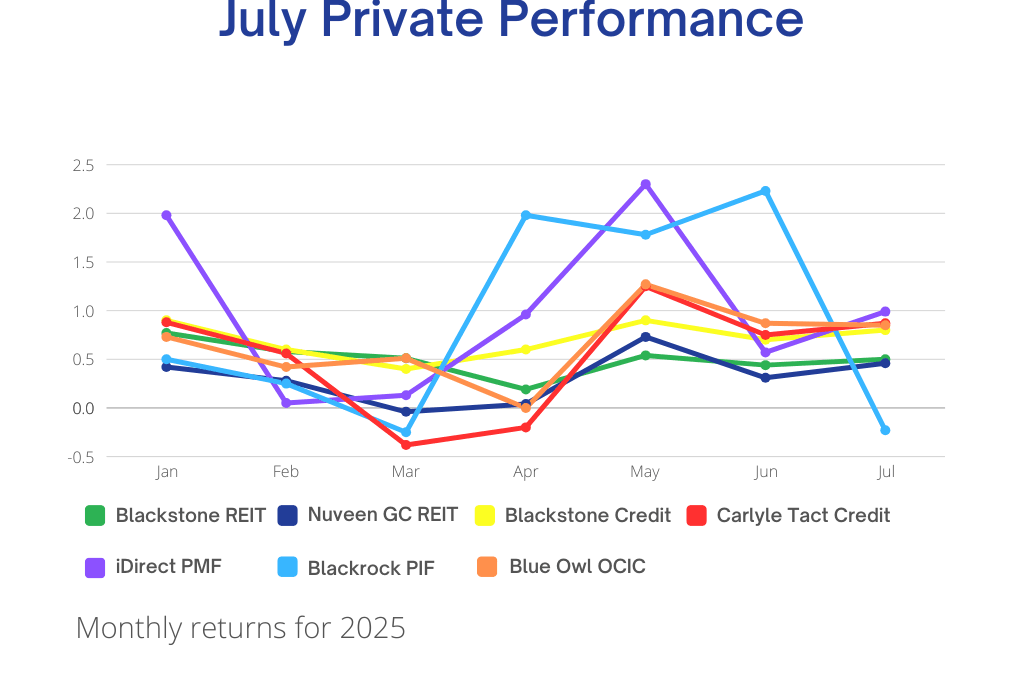

by Jacob Millican | Sep 25, 2025 | Performance

As public markets continued to wrestle with data-driven swings and short-term narratives, private investments in July remained focused on what they do best: delivering steady income, long-term growth, and low correlation to the daily news cycle. While private...

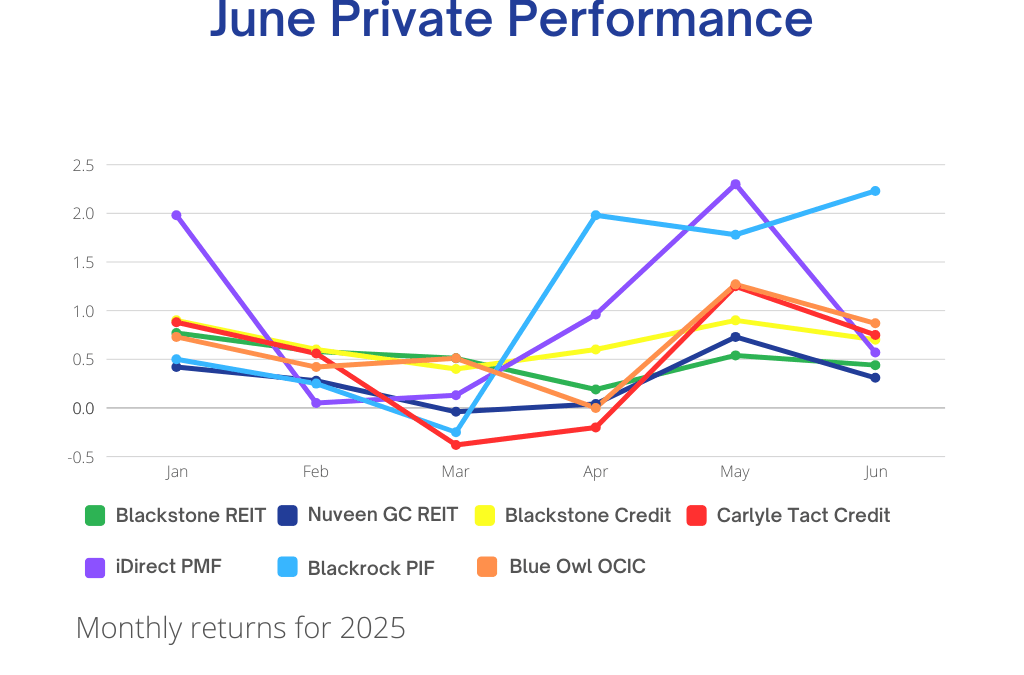

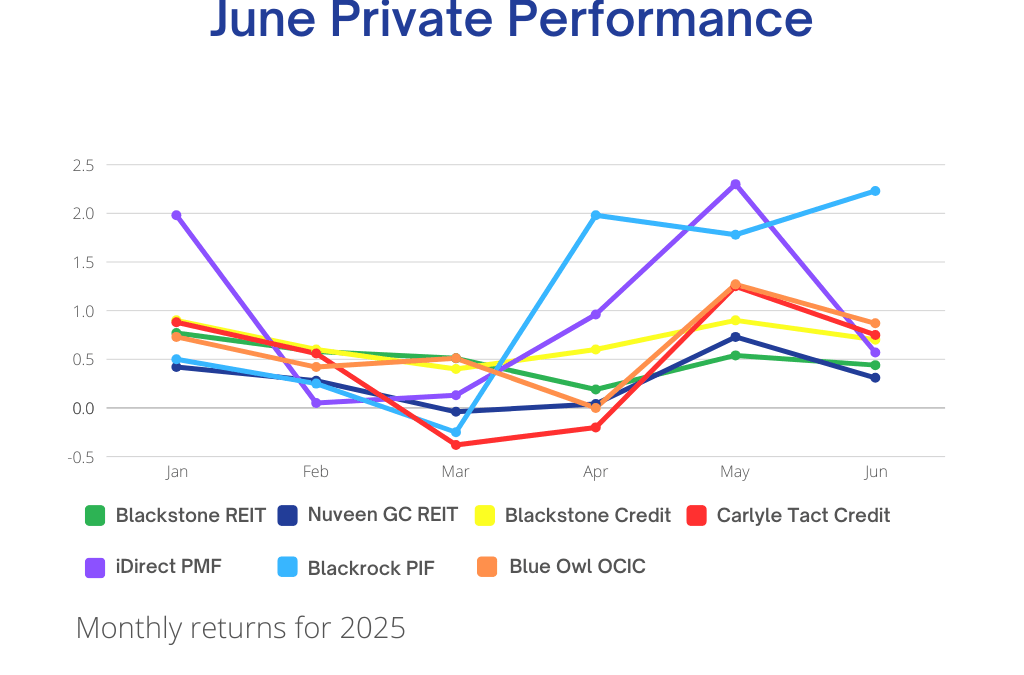

by Jacob Millican | Sep 18, 2025 | Performance

While public markets grappled with inflation prints, shifting rate expectations, and narrow leadership in stocks, June 2025 Private Investments quietly continued doing what they’re built to do: generate consistent income, capture long-term growth, and smooth out...