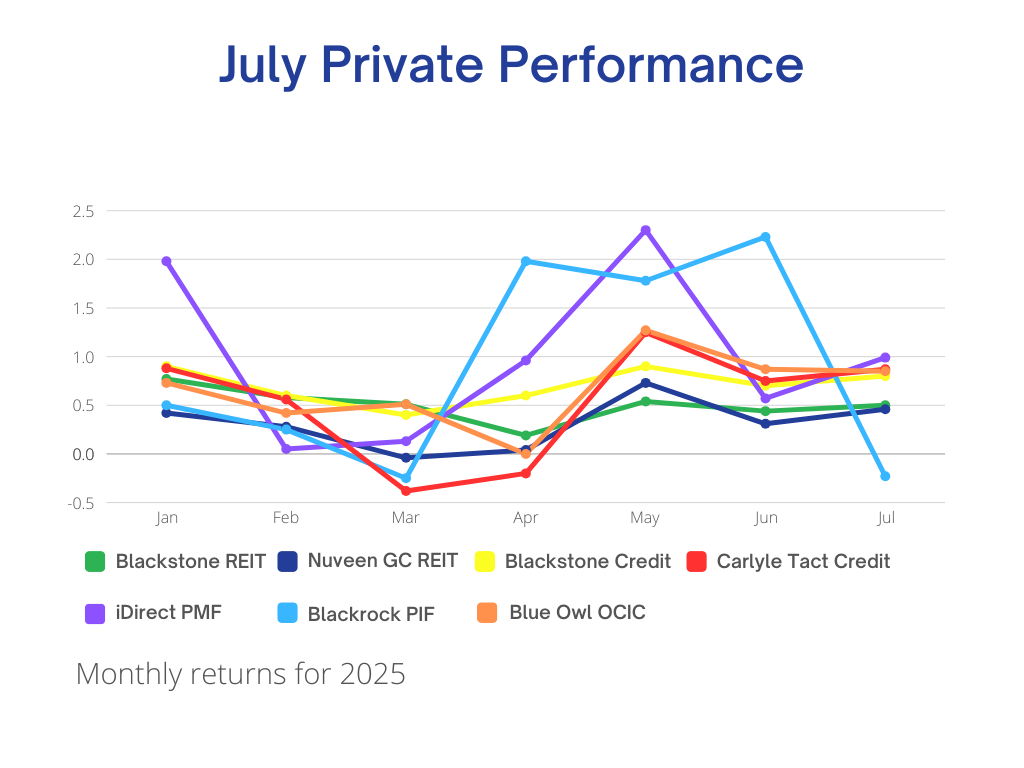

As public markets continued to wrestle with data-driven swings and short-term narratives, private investments in July remained focused on what they do best: delivering steady income, long-term growth, and low correlation to the daily news cycle. While private performance in July across funds varied modestly, the story behind the numbers remained the same — consistency, structure, and thoughtful allocation decisions that support durable wealth-building over time.

Private Equity: Discipline Over Direction

BlackRock Private Investment Fund (BPIF) saw a small pullback in July, reflecting normal month-to-month variation in a portfolio of long-term private equity holdings. The fund remains anchored in growth-oriented companies across technology, healthcare, and financial services. With many of its direct investments still in early-stage value creation, monthly volatility isn’t unexpected — nor concerning. What’s important is the overall direction: +6.39% YTD, with a strong pipeline of both primary and secondary investments.

iDirect Private Markets Fund posted a quiet gain, keeping its YTD return at +6.83%, driven by continued exposure to private equity sponsors like KKR, Vista, and Warburg Pincus. These managers have leaned into enterprise software, global consumer services, and healthcare innovation — all long-cycle themes that remain relevant even if the public markets aren’t reflecting them right now.

Private Real Estate: Quiet Yield with Global Reach, A Key Part of Private Performance in July

Blackstone REIT (BREIT) delivered another consistent month of income and modest appreciation. Its portfolio of rental housing, logistics, and data centers continues to benefit from structural demand tailwinds — particularly in fast-growing Sunbelt markets. Occupancy and leasing activity remain strong, while new development remains constrained, reinforcing long-term rental pricing power.

Nuveen Global Cities REIT (GCREIT) continued its international strategy, combining steady income from necessity retail and healthcare properties with selective growth opportunities in industrial and multifamily. With exposure to over 15 countries, it remains one of the most globally diversified REITs in the private space. The fund’s 5.56% annualized yield and conservative leverage posture reinforce its role as a core income anchor.

Private Credit: Steady Yield, Strategic Shifts Supporting Private Performance in July

Blackstone Private Credit (BCRED) continued to capitalize on high base rates and floating-rate structures. Over 97% of its loans remain senior secured and floating — which keeps cash flows strong regardless of the Fed’s short-term outlook. This structure allows BCRED to offer an attractive 10.5% distribution yield, backed by a portfolio of large, private companies across dozens of industries.

Carlyle Tactical Credit (C•TAC) continued its rebound, leaning more into structured credit and asset-backed finance while maintaining strong exposure to opportunistic and direct lending strategies. Carlyle’s ability to shift the portfolio tactically remains one of its advantages — and its recent focus on credit segments that benefit from market inefficiency continues to play out.

Blue Owl OCIC held steady, with the fund maintaining its strong 10.32% yield from senior secured, floating-rate loans. OCIC has avoided unnecessary leverage and continues to prioritize quality underwriting. Its middle-market focus offers a compelling balance of yield and stability, particularly for income-focused investors looking beyond traditional bonds.

July 2025 Performance Snapshot

| Fund | July | YTD | Annualized Dividend Rate |

|---|---|---|---|

| Blackstone REIT (BREIT)1 | 0.50% | 3.61% | 4.80% |

| Nuveen Global Cities REIT2 | 0.46% | 1.91% | 5.56% |

| Blackstone Private Credit3 | 0.80% | 5.20% | 10.5% |

| Carlyle Tactical Credit (C•TAC)4 | 0.99% | 3.88% | 9.09% |

| Blue Owl OCIC5 | 0.85% | 4.79% | 10.32% |

| iDirect Private Markets Fund6 | 0.58% | 6.83% | N/A |

| BlackRock Private Investment7 Fund (BPIF) | -.23% | 6.39% | N/A |

Conclusion: Long-Term Strategy, Short-Term Sanity

If July reminded us of anything, it’s that short-term markets often forget long-term value. Private investments, however, stay anchored in the real economy — earning interest, collecting rent, and growing companies. Whether it’s the consistent income from private credit, the tax-advantaged yield from real estate, or the long arc of growth from private equity, monitoring private performance in July reinforces these strategies as a powerful stabilizer in any well-constructed portfolio.

For more information on how these private strategies can enhance your wealth plan, and to see our full approach, visit our site 9M Investments.

Get a Free Assessment of Your Portfolio Strategy

Ready to ensure your portfolio truly captures stable growth and income, without the daily market noise? Schedule time now to get a free assessment.

- https://www.breit.com/performance/

- https://www.nuveen.com/gcreit/performance

- https://www.bcred.com/performance/

- https://www.carlyle.com/ctac

- https://ocic.com

- https://idirectpmfund.com/idirect-pm-fund/performance/#performance

- https://bpif.com/portfolio-and-performance/default.aspx

This content is developed from sources believed to be providing accurate information. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security.